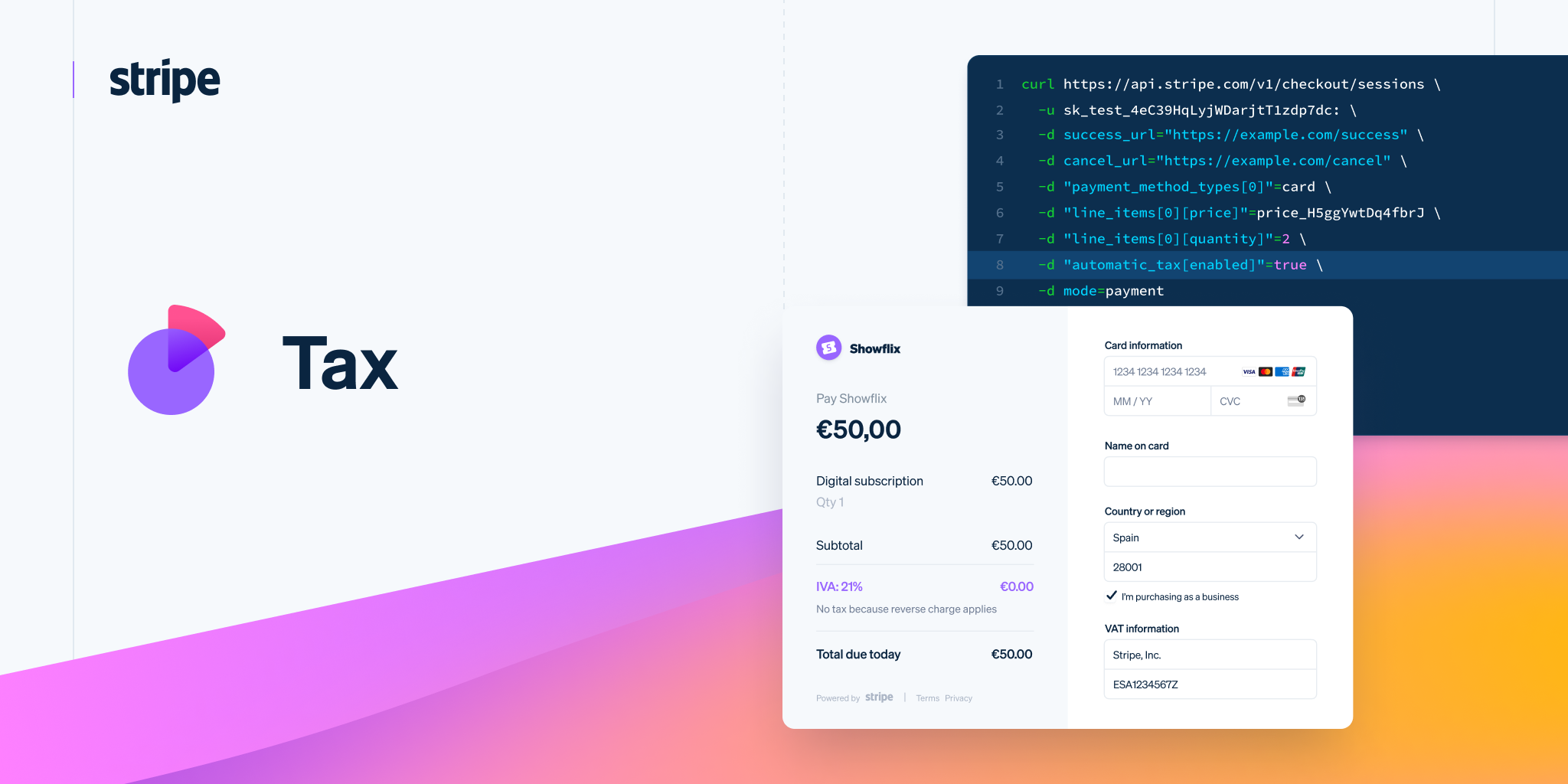

Stripe Tax for Platforms: A No-Code Solution for Tax Compliance

Stripe Tax for Platforms is a new offering from Stripe that allows platforms to offer their customers no-code tax compliance. This means that platforms can now help their customers calculate, collect, and report the correct sales tax, VAT, and GST across more than 40 countries and all US states.

The launch of Stripe Tax for Platforms is a major step forward in the fight against tax complexity. By making it easy for platforms to offer tax compliance as a service, Stripe is helping to level the playing field for businesses of all sizes.

“Help with sales tax and VAT has been our platform users’ most commonly requested feature,” said Michael Carney, product lead for Stripe Tax. “We built Stripe Tax because it’s a logical extension of payment processing, and now we’ve built Tax for platforms so platforms can offer it to their customers and help them with all aspects of the transaction lifecycle.”

Why is tax compliance so important for businesses?

Tax compliance is essential for businesses of all sizes. If businesses do not comply with tax laws, they could face significant penalties and interest. In some cases, businesses could even be shut down.

"Platforms have long supported the payments needs of their users, allowing them to do business with customers around the world through Connect. But they have not been able to provide their users with tools for managing tax obligations on those transactions. This has forced users to manage complex tax compliance on their own—exposing them to penalties and interest on top of uncollected taxes if they get it wrong", the release said.

How does Stripe Tax for Platforms work?

Stripe Tax for Platforms is a simple and easy-to-use solution. Platforms simply need to integrate Stripe Tax into their platform, and then their customers can start using Stripe Tax to calculate, collect, and report the correct sales tax, VAT, and GST.

What are the benefits of Stripe Tax for Platforms?

There are many benefits to using Stripe Tax for Platforms, including:

- No-code compliance - Stripe Tax for Platforms is a no-code solution, which means that platforms do not need to be experts in tax law to use it.

- Global coverage - Stripe Tax for Platforms covers more than 40 countries and all US states.

- Automated compliance - Stripe Tax for Platforms automatically calculates, collects, and reports the correct sales tax, VAT, and GST.

- Scalability - Stripe Tax for Platforms is scalable, so it can grow with your business.

Stripe Tax for Platforms is a powerful new tool that can help platforms and their customers to comply with tax laws. By making it easy to calculate, collect, and report the correct sales tax, VAT, and GST, Stripe Tax for Platforms is helping to level the playing field for businesses of all sizes.

About Growpay

Growpay is an online marketplace, helping simplify payment discovery for businesses worldwide. For more information, visit www.growpay.co.